So you bought the top. Or maybe you didn’t, but it still feels like everything’s bleeding. Prices are down, engagement is dead, and your portfolio looks like a crime scene.

Welcome to the bear market. It’s brutal. It’s honest. And here’s the thing: this is where the real ones are made. If you can make it through the cold, the next bull run won’t just make you whole, it could change your life.

This isn’t some hopium-laced hype piece. It’s a straightforward guide to surviving (and maybe even thriving) during the downturn. Strategies, mindsets, and the occasional coping meme are included.

You’re Not Special. Accept It.

Everyone gets rekt eventually. If you haven’t yet, you’re either brand new or in denial.

As Arthur Hayes once said, “You haven’t lived until you’ve been liquidated.”

Bear markets flip the game. It stops being about how much you can make and starts being about how little you lose. Drop the ego. Zoom out. This is just another phase of the cycle. Tourists leave. Builders stay. Survivors win.

Manage Your Head Before Your Bag

Your brain isn’t wired for 80% drawdowns. It wants to sell the bottom and FOMO the next pump. Your job? Fight that instinct.

A few things that help:

- Delete the chart apps

- Set screen time limits

- Touch some grass, seriously

- Talk to other degens (shared pain helps)

- Laugh at the memes, cry later

Vitalik Buterin nailed it in 2022: “Bear markets show who’s actually here for the tech. Your portfolio might recover. Your mental health won’t unless you protect it.”

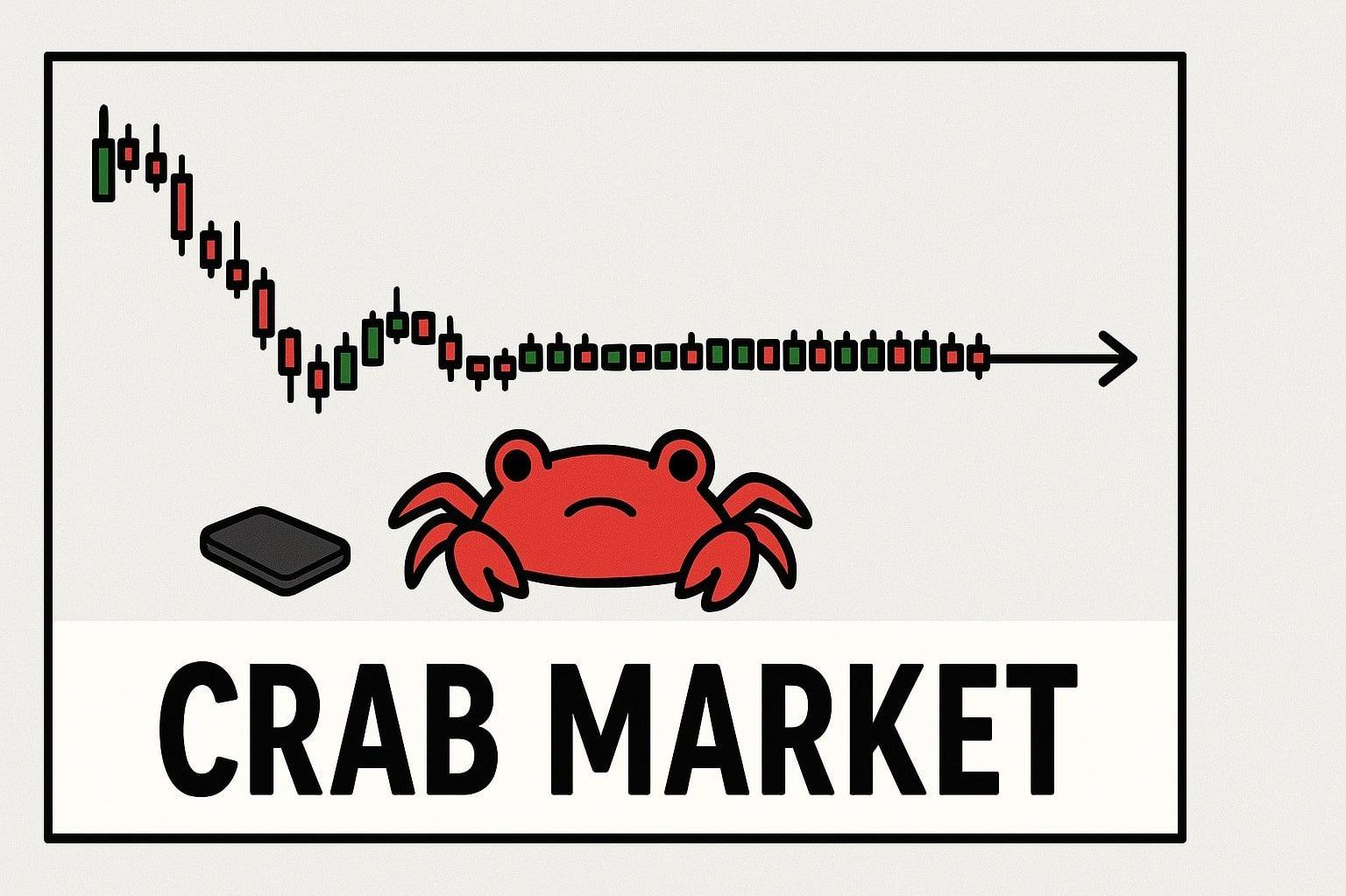

Stop Trading the Chop

Volatility is a trap. Sideways markets chew up both bulls and bears. Unless you’re a pro trader (you’re not), stop trying to outsmart the crab.

Better options:

- DCA into stuff you believe in

- Keep some cash on hand

- Set rules and stick to them

- Avoid leverage like it’s 2021

Or just chill on the sidelines. Doing nothing is a strategy as well.

Coinbase’s CEO, Brian Armstrong once said their best investments happened when everyone else was too scared to act. Keep that in mind, write it down if you must.

Use Stablecoins - It’s Not a Cult

You don’t need to be 100% in Crypto all the time. Crypto isn’t a religion.

Holding stablecoins gives you:

- Peace of mind

- Liquidity when real opportunities show up

- Flexibility when others are forced to sell

Pick your flavor: USDC, USDT, DAI - but spread your risk. And if you want to earn yield, fine. Just know what you’re getting into. Nothing is “100% safe” in crypto.

Yield Farm Carefully (or Don’t at All)

This is when you find out if that “safe 40% APY” farm was just a dressed-up Ponzi.

To farm smart:

- Stick to blue-chip protocols (Aave, Compound, Curve)

- Avoid low-volume pools and no-name tokens

- Use audited, proven platforms

- Focus on stablecoin-based strategies, risk-adjusted returns win bears

If you’re in a protocol and the Telegram is dead silent… that’s your exit cue!

Stack Skills, Not Just Coins

Bear markets are for building. And for learning.

In a bull, gamblers win. In a bear, the curious ones win. Take time to:

- Read the docs

- Learn Solidity or Rust

- Play with testnets

- Contribute to projects communities

- Explore areas like ZK or modular infrastructure

You don’t need to be a dev to contribute. But you do need to understand what’s being built, and how. As Vitalik Buterin said: “you don’t need the world, just 100 people who believe in your idea.” Bear markets are when they’re listening.

Watch Who Sticks Around

In a bull, everyone’s a genius. In a bear, you can see someone's real IQ

Keep an eye on:

- Builders still shipping

- Protocols still onboarding users

- Chains with active devs

- Founders not suddenly “pivoting to AI”

The big narratives of the next cycle usually start here. The 2020 unicorns? Most were 2018 cockroaches. Find the cockroaches, and kill them.

Guard Your On-Chain Life

Bear markets are scam season!

Watch out for:

- Phishing attacks

- Rug pulls (they never went away)

- Protocol collapses

- Sketchy DMs and fake airdrop ads on X

Stay paranoid. Best practices:

- Use a hardware wallet

- Keep funds off exchanges unless you’re actively trading

- Double-check every transaction and signer

- Don’t click random links, ever!

If it sounds too good to be true… it’s probably airdrop bait.

Keep Showing Up

Consistency > intensity.

You don’t need to grind 24/7 or time every bottom. Just keep showing up. Keep learning. Stay engaged. That alone puts you ahead of most people who tap out.

An OG once said: “The bear market is the tax you pay for the bull market you want.” Pay it. Then stick around for a tax refund.

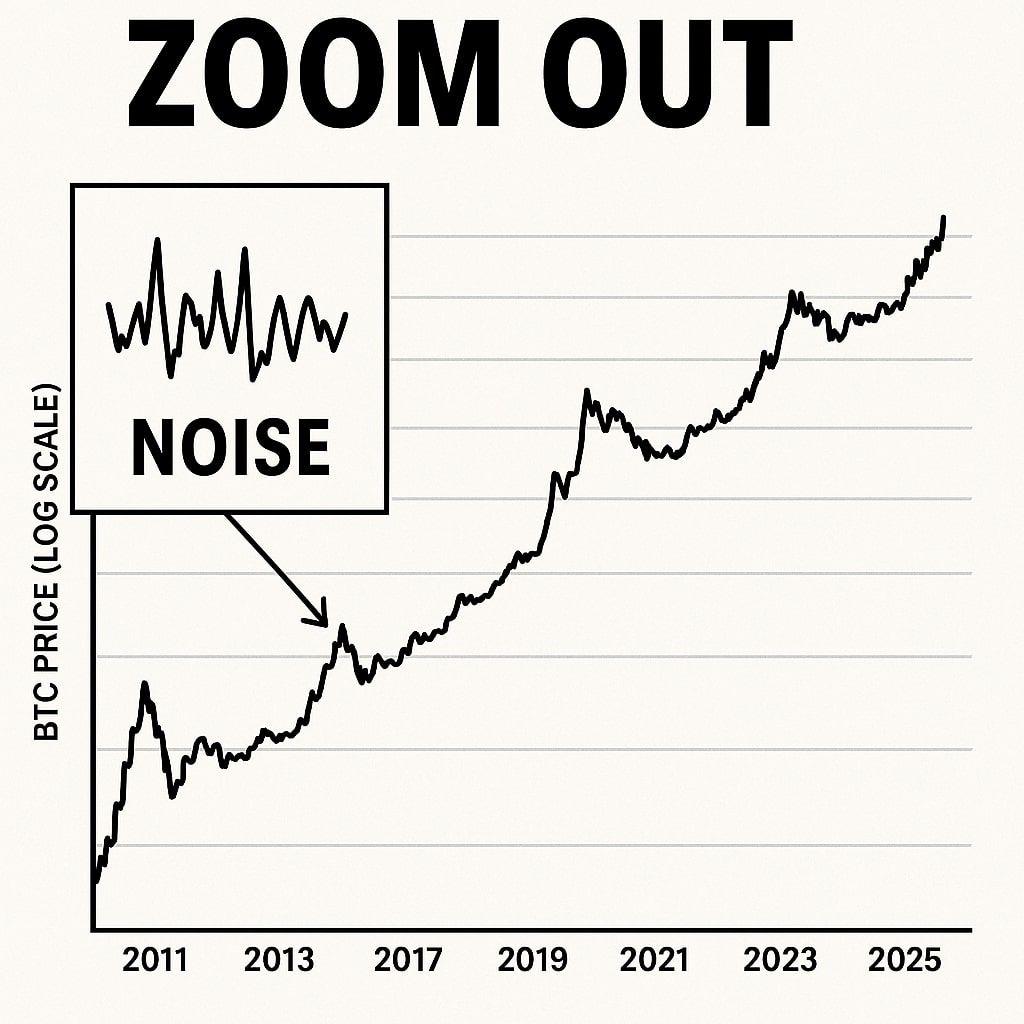

Zoom the Hell Out

Bitcoin at $30K feels rough if you bought at $65K. But go ask the guy who bought it for $500.

Perspective matters. Zoom out far enough, and all this noise fades into a chart of higher highs. That’s not cope, that’s history repeating itself

You got into this space for a reason. Open markets. A shot at something better than the rat race. That dream didn’t die with a meme coin you aped into. It’s just on pause.

Final Thoughts: WAGMI Is Earned

Bear markets test conviction. They don’t hand out prizes, they forge them.

If you’re still here, still reading, still learning, you’re already ahead, seriously!

This part of the cycle feels hopeless because it’s supposed to. That’s how bottoms form. That’s how opportunity hides. So keep your head clear. Keep your wallet safe. Keep showing up. When the bull returns…and it will, people will wonder where you came from.

You’ll know. You never left the trenches when everyone else did