Web3 is a term you’ve probably seen everywhere, crypto forums, startup pitches, and even mainstream news. But what does it mean?

At its core, Web3 is the vision for a new internet, one that’s decentralized, trustless, and owned by its users. Instead of platforms profiting from your data, Web3 aims to flip the script: you own your identity, your assets, and your piece of the internet.

In this guide, we’ll walk through the journey to Web3, from the invention of Bitcoin to today’s cutting-edge developments like SocialFi, DAOs, and AI-powered crypto tools. Whether you’re a total beginner or just crypto-curious, this guide will make it all click.

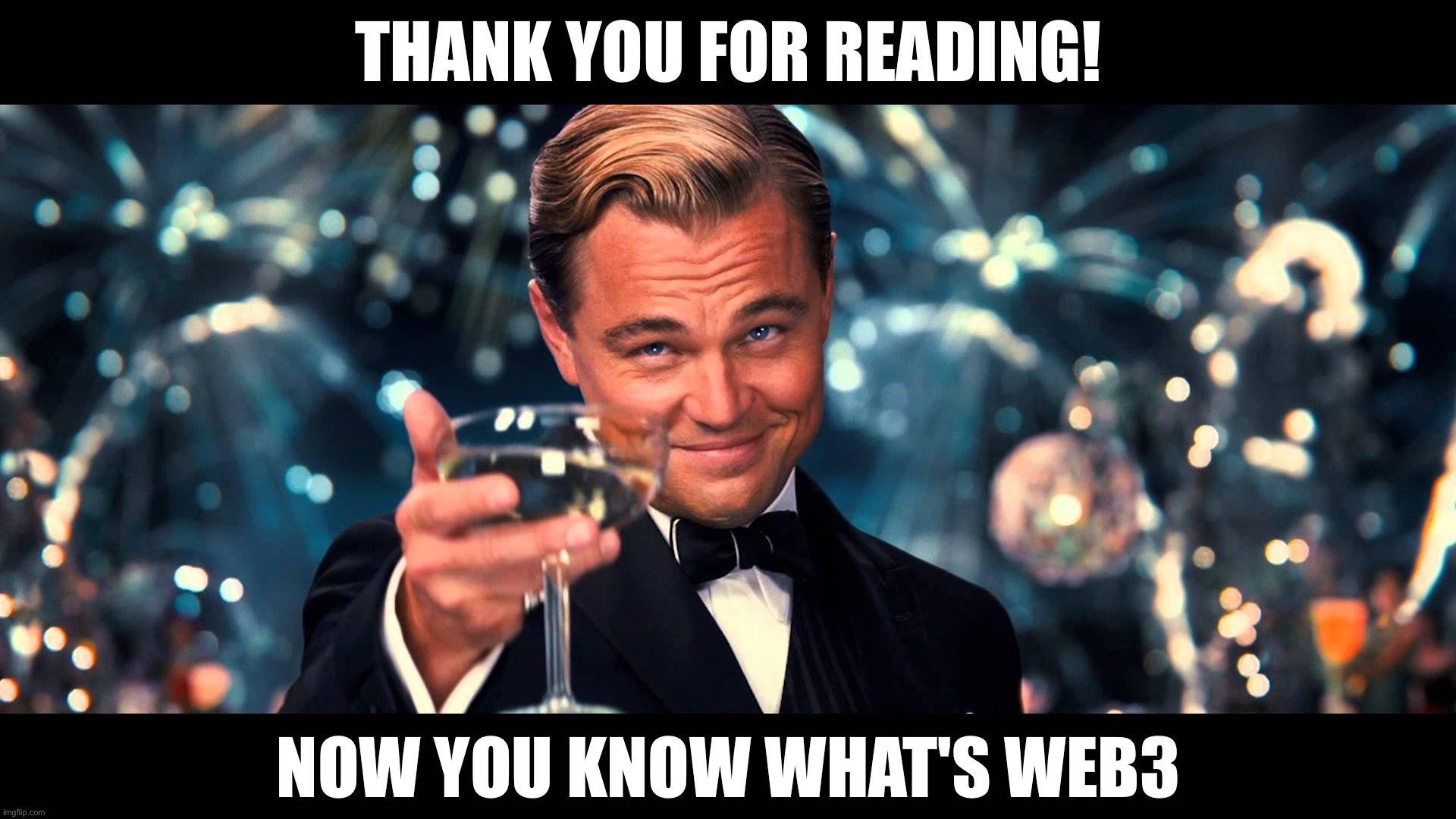

Fig 1: infographic visually depicting the difference between the internet, web 1.0, web 2.0 & web 3.0 from Program Ace

1. Bitcoin: The Birth of Decentralized Money (2009)

Bitcoin is where it all started.

In 2008, a mysterious figure known as Satoshi Nakamoto released a whitepaper titled “Bitcoin: A Peer-to-Peer Electronic Cash System,” proposing a new form of money that didn’t require a bank or government to work. A year later, in 2009, the Bitcoin network launched, and history was made.

What made Bitcoin revolutionary?

- No middlemen: Anyone with an internet connection could send or receive Bitcoin.

- Limited supply: Only 21 million Bitcoins will ever exist, making it digitally scarce like gold.

- Public ledger: Every transaction is recorded on the blockchain, making fraud nearly impossible.

Real-world analogy:

Think of Bitcoin as email for money. Before email, you needed a postal service. With email, you can send messages instantly. Bitcoin did the same for money, cutting out the middlemen.

Today, Bitcoin is known as “digital gold”, a hedge against inflation and censorship. It’s also the philosophical foundation of Web3: decentralization, openness, and user control.

Fig 2: Bitcoin trading chart from 2009 till the present day

2. Ethereum: The World’s Decentralized Computer (2015)

Bitcoin proved money could be decentralized. But what about apps?

In 2015, a 21-year-old programmer named Vitalik Buterin launched Ethereum, a blockchain that introduced smart contracts, programmable pieces of code that live on the blockchain and execute automatically when certain conditions are met.

This was a game-changer. Suddenly, developers could build decentralized applications (dApps) that:

- Don’t rely on centralized servers.

- Can’t be taken down by a company or government.

- Interact directly with users’ crypto wallets through ENS

What Ethereum enabled:

- Decentralized exchanges like Uniswap

- Lending platforms like Aave

- NFT marketplaces like OpenSea

- Entire communities governed by tokens (DAOs)

Think of Ethereum like the App Store of Web3, except no company controls it.

Want to create your own currency? Launch a DAO? Build a game where users own their items. Ethereum made all of that possible.

Fig 3: Ethereum trading chart from 2015 till the present day

3. Crypto Wallets: Your Key to the Web3 World

If blockchains are the new internet, then crypto wallets are your browser, passport, and bank account, all in one.

A crypto wallet lets you:

- Store and manage cryptocurrencies

- Connect to decentralized apps (dApps)

- Sign in securely, without usernames, passwords, or email addresses

Popular crypto wallets:

- MetaMask (browser extension + mobile)

- Trust Wallet

- Coinbase Wallet

Custodial vs. Non-Custodial:

- Custodial: Your keys are stored by a third party (like Binance or Coinbase).

- Non-custodial: You hold the private keys, meaning you’re in full control.

Beginner tip:

When you create a wallet, you’ll receive a seed phrase (12–24 random words). This is your master key. Store it offline and never share it. If you lose it, you lose access to your funds.

Analogy:

Think of your wallet as your digital safe, and the seed phrase as the combination. Only you know it.

With a crypto wallet, you can:

- Swap tokens

- Buy NFTs

- Vote in DAOs

- Interact with apps across the Web3 universe

For more info on Crypto Wallets, you can read our blog post.

Fig 4: Infographic listing the different Crypto Wallets from a blog post written by FX Leaders

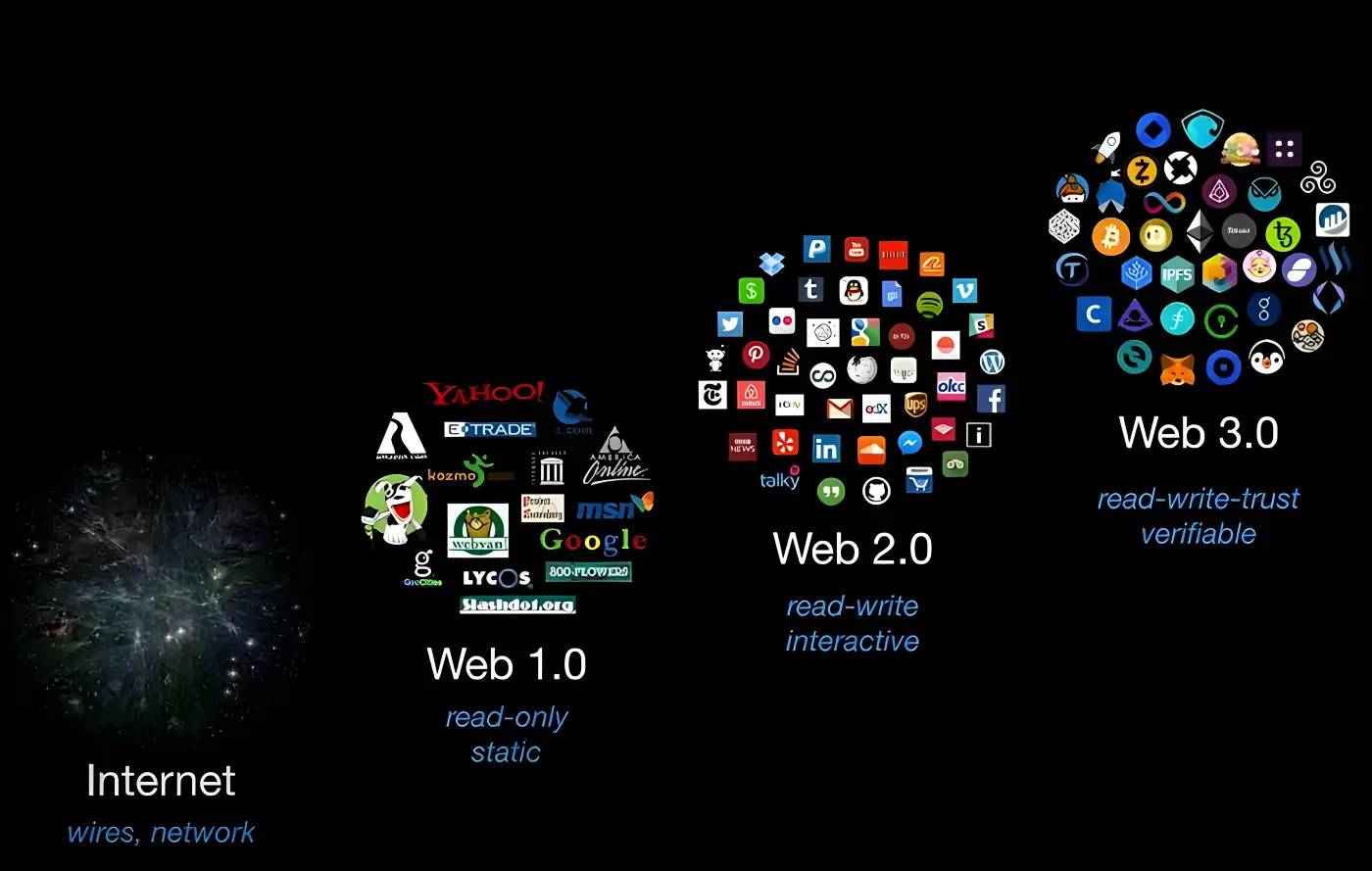

4. NFTs: Own Anything, Digitally

NFTs (Non-Fungible Tokens) represent ownership of unique digital items, art, music, videos, collectibles, game items, and even virtual real estate.

Unlike cryptocurrencies like Bitcoin (which are interchangeable), each NFT is one-of-a-kind.

What makes NFTs powerful?

- Provenance: The blockchain shows who owns what, and when they bought it.

- Royalties: Artists can earn a percentage each time their work is resold.

- Interoperability: NFTs can be used across games, apps, and metaverses.

Real-world examples:

- Artist Beeple sold an NFT for $69 million at Christie’s.

- The Bored Ape Yacht Club became a global digital brand.

- Musicians like Snoop Dogg launched NFT albums that fans could own and resell.

Why NFTs matter for Web3:

They give creators power. Instead of relying on Spotify, YouTube, or Instagram to monetize, artists can go direct-to-fan, and fans become co-owners.

Use cases beyond art:

- Event tickets

- VIP memberships

- Domain names (e.g. yourname.eth)

- Proof of attendance and education credentials

Analogy:

If Web2 lets you stream a song, Web3 lets you own it, and share in its value.

Fig 5: Beeple NFT that sold for $69 million dollars

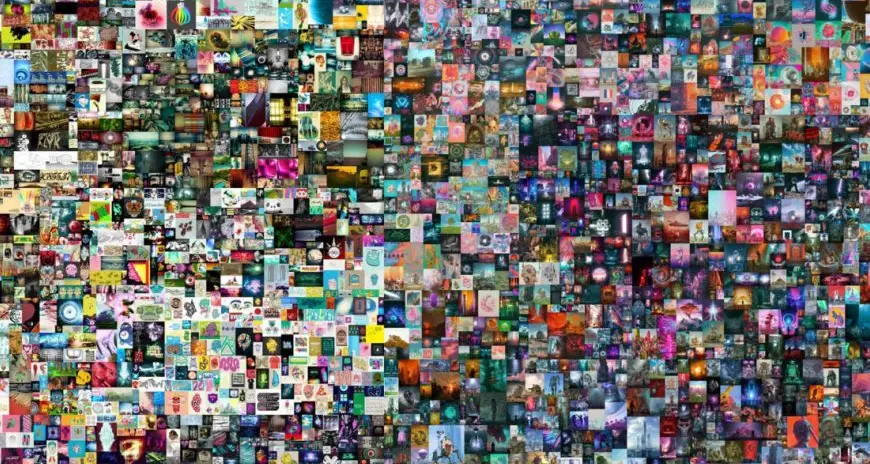

5. DeFi: Finance Without Banks

Defi, short for Decentralized Finance, is one of the most powerful ideas in Web3.

It refers to a growing ecosystem of financial tools like lending, borrowing, trading, and saving, built on blockchains like Ethereum, with no banks or brokers involved.

What DeFi enables:

- Anyone can earn interest on crypto

- Borrow funds instantly using collateral

- Trade tokens peer-to-peer using smart contracts

- Join liquidity pools to earn a share of fees

Popular DeFi apps:

- Uniswap: Token swapping without an exchange

- Aave: Lending and borrowing

- Curve: Stablecoin trading

- Yearn: Yield farming strategies

Example:

Deposit 1,000 USDC into Aave. Other users borrow it, and you earn interest, automatically. There’s no credit check, paperwork, or bank involved.

Risks to watch out for:

- Smart contract bugs

- Market volatility

- Impermanent loss in liquidity pools

Why DeFi matters:

It’s leveling the financial playing field. People in any country can access services previously restricted to the wealthy or banked. DeFi is finance built for the internet.

Fig 6: Infographic from De.Fi explaining how DeFi works

6. Meme Coins: Culture as Currency

Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) started as jokes, but they’ve become billion-dollar ecosystems.

What sets meme coins apart?

- They often have no serious tech or utility.

- They grow based on community hype and virality.

- They’re driven by memes, influencers, and social sentiment.

Why do people buy meme coins?

- Low entry prices (“I own 1 million SHIB!”)

- FOMO and speculative upside

- A sense of fun and shared internet culture

Caution:

Most meme coins are highly volatile and prone to pump-and-dump cycles. They aren’t built for long-term utility, but they highlight an important Web3 trend:

Memes are culture. And in Web3, culture has value.

For a deep dive on the Top 10 meme coins by marketcap, head to our blog post

7. SocialFi: Rebuilding Social Media

SocialFi = Social media + Decentralized Finance.

The idea? Replace traditional social platforms (like Facebook and Twitter) with user-owned networks where:

- You own your profile and content.

- You earn tokens for posting, sharing, and curating.

- You can take your followers and data wherever you go.

Leading SocialFi platforms:

- Lens Protocol: A Web3 social graph that powers many apps

- Farcaster: Decentralized Twitter alternative

- Friend.tech: Tokenize access to your private content

Example:

You publish a blog post on a Lens-powered app. Readers can collect it as an NFT, share it, or tip you directly. You earn crypto, not just likes.

Why SocialFi matters:

Web2 made you the product. SocialFi makes you the owner. You don’t just post—you participate in value creation.

Bonus:

Your identity becomes portable. You can log into any Lens-based app and keep your followers, posts, and reputation.

8. How Big Brands Are Using Web3

Web3 isn’t just for crypto natives. Major companies are experimenting with NFTs, tokens, and blockchain-based tools to reach customers in new ways.

Here’s how:

NFTs for loyalty and collectibles:

- Nike acquired RTFKT to sell digital sneakers.

- Adidas launched NFT collaborations with Bored Apes and Punks.

- Reddit created “Collectible Avatars” on Polygon.

- Starbucks Odyssey offered NFTs as loyalty rewards (e.g. virtual stamps tied to perks).

Blockchain for payments:

- PayPal released PYUSD, a U.S. dollar-backed stablecoin.

- Visa and Mastercard rolled out crypto payment rails and NFT experiments.

Supply chain transparency:

- IBM and Walmart used blockchain to track food safety in logistics.

- De Beers used blockchain to verify the origin of diamonds.

Why it matters:

These brands aren’t adopting Web3 to be trendy. They’re doing it because:

- NFTs enable direct engagement with fans.

- Tokens enable reward systems without middlemen.

- Blockchain adds trust and transparency to processes and payments.

The takeaway:

Web3 is gradually merging with Web2. And when the tools are seamless enough, you might use Web3 without even realizing it.

Fig 7: Big brands that are utilising NFTs for marketing purposes

9. Freelancers and the Web3 Work Revolution

Web3 is unlocking new ways to work, earn, and collaborate, especially for freelancers and remote workers.

Why it’s different:

- Work with no borders: Join projects from anywhere.

- Get paid in crypto: Fast, global, censorship-resistant.

- Join DAOs (Decentralized Autonomous Organizations): Work for communities, not companies.

Examples of Web3 Jobs:

- Writing content for a DeFi protocol (copywriter

- Designing NFT art (Graphics Designer)

- Create marketing strategies (Social Media Manager)

- Moderating a Discord or Telegram Group (Moderator)

- Coding smart contracts or building tools (Smart Contract Developer

Platforms to find Web3 work:

- CryptoJobsList (Largest Web3 Job Platform)

- TalentLayer

- Dework

- DAO job boards (e.g., BanklessDAO, Gitcoin)

Real-world example:

You join a DAO focused on climate action. You write a research post, get it published, and are paid 300 USDC. No resume. No interview. Just value delivered and rewarded.

How this changes work:

- Permissionless: Anyone can contribute.

- Pseudonymous: Use your wallet + reputation, not your real name.

- Token ownership: Many contributors earn governance tokens and ownership in the project itself.

Bottom line:

Web3 is building an economy where you don’t need a job, you need a wallet and a skill.

Fig 8: CryptoJobsList, the largest web3 job platform made for freelancers and Web3 companies alike

10. AI + Web3: The Smart Internet

Two major tech waves are converging: AI and crypto. Here’s how they work together:

1. AI on the blockchain

- AI services can live on decentralized platforms.

- Projects like SingularityNET offer marketplaces where AI developers offer their models as services.

- Anyone can access or contribute, using tokens to pay and incentivize.

2. Crypto for AI accountability

- Blockchains can track how AI decisions are made, and audit trails for automated decisions.

- Useful in healthcare, legal, or financial applications where you want to understand why an AI made a choice.

3. Decentralized data for AI

- AI models need data. Blockchain tools like Ocean Protocol create decentralized data marketplaces where users control their data and get paid to share it.

4. Autonomous agents (AI Agents)

Imagine an AI bot with a wallet. It could:

- Book your travel

- Trade tokens

- Rent compute power from another protocol

- Pay others, all autonomously!

This isn’t science fiction. It’s Web3 meets machine economy.

Why this matters for you:

AI makes Web3 more powerful. Web3 makes AI more ethical and transparent. Together, they create a smarter, fairer internet.

To learn more, read our blog post on the Top AI Agents

11. The Future of Web3

Web3 is still early, but the signs are clear. The foundations are in place, and the next wave is coming.

What’s ahead:

1. Better user experience

- Wallets will be invisible.

- Gas fees will be subsidized or abstracted.

- You’ll sign in with one click—no more “seed phrases” for casual users.

2. Mainstream apps

- Web3 gaming with NFT characters and digital economies.

- Social apps where your content earns you tokens.

- Tools where your reputation lives in your wallet, not on LinkedIn.

3. Regulation and clarity

- Clear rules will bring confidence.

- Bad actors will be filtered out.

- Real innovation will thrive with fewer scams and more security.

4. Global Inclusion

- Billions of unbanked people can now access financial tools, jobs, and marketplaces, with just a phone and a wallet.

TL;DR: Why Web3 Matters

Web3 isn’t just another tech trend. It’s a fundamental reimagining of how the internet works, who owns it, who controls it, and who benefits.

Web1: Read

You could read content online.

Web2: Read + Write

You could read and post, but platforms owned the data.

Web3: Read + Write + Own

You own your identity, assets, and content. You participate in governance. You get rewarded for contributing.

In Web3, you’re not just a user, you’re a stakeholder.

Whether you’re:

- Sending your first Bitcoin

- Buying an NFT

- Voting in a DAO

- Playing a game with on-chain assets

- Getting paid in USDC for a remote job

You’re already stepping into the Web3 world.

And the best part? You’re still early.