Key Takeaways

- While the crypto market has faced challenges, it is not dead.

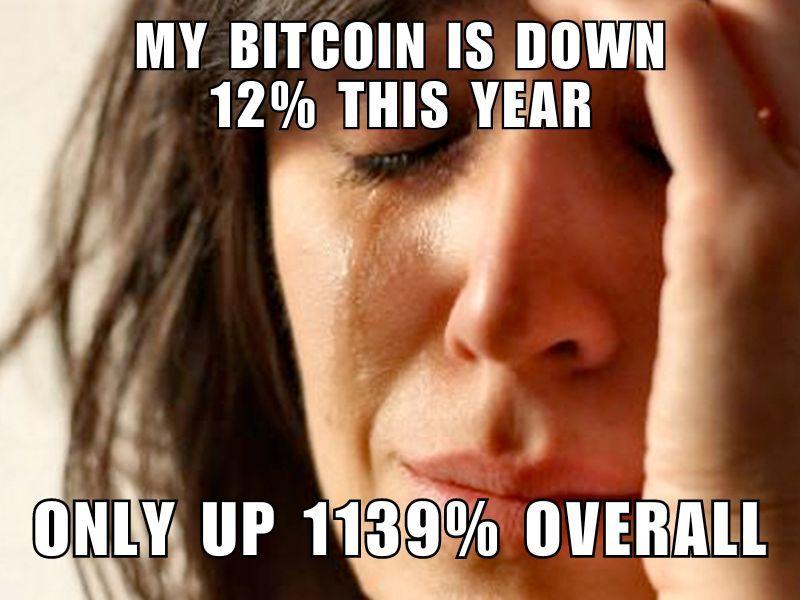

- Volatility and fluctuation are inherent to the crypto market.

- Crypto projects are expanding and finding diverse use cases.

- Regulation presents both challenges and opportunities for the crypto industry.

- The future of crypto holds the potential for widespread acceptance and growth.

Have you heard the rumors swirling around the crypto market? Some say crypto is dead, while others claim it's just taking a breather. The market sentiment is divided, and it's hard to separate fact from fiction. So, let's look into the industry of cryptocurrencies and reveal the truth behind the hype.

The crypto market, like any other financial market, experiences ups and downs. Volatility and fluctuation are part and parcel of this exciting and unpredictable space. But does that mean crypto is dead? Not so fast. While the recent bear market and the infamous "crypto winter" have caused concern, it's important to take a closer look at the bigger picture.

In this article, we'll explore the current state of the crypto market and evaluate whether it's truly dead or if it's just hibernating. We'll examine the rise of crypto projects and their potential use cases, the impact of regulatory challenges and compliance, and the future predictions and projections for the industry.

Understanding the Crypto Market's Ups and Downs

Let's explore the ins and outs of the crypto market, and how its inherent volatility and fluctuation can impact your investments. It's important to understand the dynamics at play, regardless of your experience level.

First and foremost, what exactly is cryptocurrency? Simply put, it's a digital or virtual form of currency that operates independently of a central bank. The most well-known cryptocurrencies are Bitcoin and Ethereum, but there are thousands of other crypto assets out there, each with its unique characteristics.

The crypto market is subject to market sentiment, which can cause prices to skyrocket or nosedive. Market sentiment refers to the overall attitude and emotions of investors towards a particular cryptocurrency. Positive sentiment can drive up prices, while negative sentiment can cause them to plummet. So, keeping a finger on the pulse of the market sentiment is essential.

But what causes this volatility and fluctuation in the market? Well, it's a combination of factors, including investor speculation, regulatory developments, technological advancements, and even media coverage. News of a major exchange hack or a government crackdown on cryptocurrencies can quickly send shockwaves through the market, impacting prices and volatility.

It's important to note that while the crypto market can be highly unpredictable, it also opens up opportunities for significant gains. The market cap of cryptocurrencies has been on a steady rise, showcasing the growing interest and adoption of digital assets. However, it's important to approach the market with caution, and never invest more than you can afford to lose.

Now that you have a grasp of the ups and downs of the crypto market, let's dig deeper into the concept of the Crypto Winter - a period of prolonged market downturn - in the next section.

The Crypto Winter: A Temporary Chill or An Enduring Ice Age?

Ah, the crypto winter! It sounds like something straight out of Game of Thrones, doesn't it? But in the industry of cryptocurrencies, the crypto winter refers to a period of prolonged bear market conditions. Some may say it's the death knell for the crypto industry, while others see it as just a temporary setback in the market cycle.

Now, let's dig deeper into this phenomenon. Is the crypto winter really the end of Bitcoin and other cryptocurrencies? Well, not necessarily. Just like winter eventually gives way to spring, the crypto market has a way of bouncing back. Remember, Bitcoin has survived multiple market crashes and has been declared dead more times than we can count but it always manages to defy the naysayers and come back stronger.

But what about the market projections for 2025 and beyond? While it's impossible to predict the future with absolute certainty, industry experts believe that the crypto industry will continue to expand and grow. This means that the crypto winter is more likely to be a temporary chill rather than an enduring ice age.

Why the crypto winter may not be as grim as it seems:

- The crypto industry is still in its early stages and has a lot of untapped potential.

- Institutional investors are showing increasing interest in cryptocurrencies, which could lead to a surge in demand.

- New technologies and innovations, such as decentralized finance (DeFi), are constantly emerging, bringing new possibilities to the crypto market.

- Growing mainstream acceptance of cryptocurrencies, with companies like PayPal and Tesla embracing digital assets.

So, while the crypto winter may leave us shivering for a while, it's important to remember that winter is just a season, and seasons change. The crypto industry is resilient, adaptable, and constantly growing. So, don't write off Bitcoin and other cryptocurrencies just yet. The future may hold some surprises, and the crypto winter could be the catalyst for even greater growth in the years to come.

The Rise of Crypto Projects and Use Cases

As the cryptocurrency market continues to gain traction, an increasing number of crypto projects are emerging with innovative use cases across various industries.

Blockchain technology lies at the center of these projects, providing a secure and transparent platform for digital asset transactions and enabling decentralized applications.

One of the most intriguing aspects of crypto projects is their versatility in addressing real-world challenges. From supply chain management and healthcare to finance and voting systems, the potential use cases are vast and seemingly limitless.

For example, in the finance industry, crypto projects are revolutionizing the way we transact and store value. Digital currencies, such as Bitcoin and Ethereum, offer an alternative to traditional fiat currencies, allowing for faster and more cost-effective cross-border transactions.

In addition, crypto projects are creating opportunities for individuals to invest in and hold digital assets. These assets, represented as tokens on the blockchain, provide a way to diversify investment portfolios and participate in the digital economy.

Examples of Crypto Projects and Use Cases:

- A supply chain project leveraging blockchain technology to track and authenticate the origin and movement of goods, ensuring transparency and eliminating counterfeit products.

- A healthcare project that stores medical records securely on the blockchain, providing patients with easy access to their data and enabling interoperability between healthcare providers.

- A decentralized finance (DeFi) project that offers lending and borrowing services without the need for traditional intermediaries, unlocking financial services for individuals who are underserved by the traditional banking system.

- A voting system project using blockchain to ensure tamper-proof and transparent elections, gaining trust and integrity in the democratic process.

These examples demonstrate just a fraction of the potential that crypto projects and blockchain technology hold in transforming various industries. As the ecosystem expands and grows, we can expect to see even more innovative solutions and use cases emerge.

So, while skeptics may raise doubts about the longevity of cryptocurrencies, the rise of crypto projects and their practical applications in the real world certainly challenge the notion that crypto is just a speculative digital asset.

Bitcoin Halving and the Potential for a Bull Run

The crypto market is no stranger to excitement and speculation, and one event that never fails to stir up interest is the Bitcoin halving. This significant event, which occurs approximately every four years, has a direct impact on the supply and demand dynamics of Bitcoin, making it an eagerly anticipated milestone for investors and enthusiasts alike.

What is Bitcoin Halving?

Bitcoin halving is a pre-programmed event in the Bitcoin protocol that reduces the reward miners receive for validating transactions and adding them to the blockchain. It happens every 210,000 blocks, which roughly translates to around every four years. The most recent halving occurred in May 2020.

The Impact on the Crypto Market

The reduction in the rate at which new Bitcoins are created during halving events has historically been associated with an increase in Bitcoin's value. This is because the decreased supply of new Bitcoins, coupled with sustained or growing demand, creates a potential bull run scenario.

Investors often see halving events as a catalyst for increased market activity, as the scarcity of new Bitcoins drives up prices and generates momentum for the entire crypto market.

The Role of Investor Sentiment

Market sentiment plays an important role in determining the direction of the crypto market, especially during significant events like halving. Positive sentiment, driven by factors such as improved market confidence and media attention, can fuel a bull run, leading to exponential price increases.

Investors should keep a close eye on market sentiment indicators and news surrounding Bitcoin halving events to make informed investment decisions.

It's important to note that while past halving events have resulted in bull runs, there are no guarantees. The crypto market is volatile, and many factors beyond halving can influence its dynamics.

The Role of Crypto Exchanges

Crypto exchanges, as the primary platforms for trading cryptocurrencies, play a significant role during halving events. Increased trading volumes and the potential for a bull run can lead to higher market liquidity and enhanced trading opportunities.

Investors should choose reputable exchanges with strong security measures and a wide range of trading options to take full advantage of potential market movements during a halving event.

In conclusion, Bitcoin halving events create an atmosphere of anticipation and excitement in the crypto market. While historical data suggests the potential for a bull run following halving, it's important to approach investment decisions with a balanced perspective, considering factors beyond this singular event and closely monitoring market sentiment and exchange dynamics. With proper research and strategic decision-making, investors can position themselves for success in this dynamic market.

Regulation and Compliance: Challenges and Opportunities

The role of regulators, including the Securities and Exchange Commission (SEC), is indispensable. Crypto companies, from Silicon Valley startups to the world’s largest crypto exchanges, work with a complex web of regulatory developments, aiming to align with compliance while fostering innovation.

The SEC's efforts to regulate the crypto industry have both posed challenges and presented opportunities for companies like FTX and Coinbase. These regulations aim to protect investors and promote fair and transparent practices in the crypto market.

Challenges in Regulatory Compliance

- Complexity and Uncertainty: The dynamic nature of cryptocurrencies presents unique challenges in regulatory compliance. The SEC must work with complex technical frameworks and establish clear guidelines in an expanding industry.

- Global Regulatory Fragmentation: Cryptocurrencies operate on a global scale, making it challenging to implement consistent regulations across different jurisdictions. Divergent regulations can create compliance hurdles for crypto firms and exchanges.

- Security and Privacy Concerns: Striking a balance between security and privacy is important in the crypto space. Transparency requirements can clash with the need to protect user data, creating compliance dilemmas for businesses.

Opportunities for the Crypto Industry

- Enhanced Credibility: Regulatory compliance can help build trust and credibility within the crypto industry. By adhering to regulations set by the SEC and other authorities, crypto firms and exchanges can establish themselves as trustworthy and reliable platforms for investors.

- Increased Investor Protection: Regulations aim to protect investors from fraudulent practices and market manipulation. By implementing robust compliance measures, crypto firms can attract more investors who feel confident in the security and fairness of the market.

- Mainstream Adoption: Clear and well-defined regulations can facilitate the integration of cryptocurrencies into mainstream financial systems. They provide a framework that encourages traditional financial institutions to embrace cryptocurrencies, leading to greater acceptance and widespread adoption.

While regulatory compliance poses challenges for crypto firms and exchanges like FTX and Coinbase, it also presents opportunities for growth and legitimacy within the industry. By overcoming these challenges and embracing regulations, crypto businesses can foster trust, attract more investors, and drive the mainstream adoption of digital assets for the benefit of all.

The Future of Crypto: Predictions and Projections

Looking toward the future of crypto, predictions and projections for 2025 and 2026 highlight the enduring potential of cryptocurrencies to revolutionize the financial system. Despite skepticism from crypto doubters, the future of crypto appears bright. Regulatory advancements and growing mainstream acceptance of cryptocurrencies as legitimate financial tools are fueling positive momentum.

One of the key factors driving the growth of the crypto industry is the emergence of numerous cryptocurrencies. While Bitcoin remains the largest crypto, many other cryptocurrencies have gained substantial traction and market value. This diversification brings exciting opportunities for investors and users alike.

Market Forecasts for 2025 and 2026

- Experts predict significant growth in the cryptocurrency market over the coming years. By 2025, the market is projected to reach new heights, with a significant increase in overall market capitalization. According to Forbes, "If bitcoin experiences that same rate of appreciation in its average annual returns, it will reach $98,700 in January 2025 and hit $100,000 in February of that same year."

- Additionally, by 2026, cryptocurrencies could establish themselves as a legitimate asset class, attracting increased attention from traditional investors and institutional players. Wellington predicts that valuing crypto asset class can "range from US$100,000 to more than US$500,000 by 2026."

- The increasing adoption of cryptocurrencies by businesses and individuals is expected to contribute to the market's growth, particularly as the technology and infrastructure supporting crypto transactions continue to improve.

The Implications for the Cryptocurrency Market

Should cryptocurrencies achieve widespread acceptance as an asset class, the implications for the crypto industry are substantial. Increased recognition and legitimacy could lead to more regulatory clarity, improved infrastructure, and heightened investor confidence.

Furthermore, as the crypto industry matures, there is a potential for increased innovation in blockchain technology, leading to new use cases and applications across multiple industries. This ongoing development could result in a positive feedback loop, driving further growth and adoption.

It's worth noting that while market projections and predictions provide valuable insights, the future of the crypto industry remains uncertain. However, the overall trajectory suggests that cryptocurrencies have the potential to play a significant role in the financial sector in the years to come.

Frequently Asked Questions

Q1. Is crypto still a good investment?

Cryptocurrencies are a volatile and risky investment. While they have the potential for high returns, they also hold the potential for significant losses. Before investing, consider your risk tolerance and do your research to understand the specific cryptocurrencies you're interested in.

Q2. How can blockchains help AI?

Blockchains can assist AI in several ways. They can provide secure and transparent data storage for training AI models, facilitating data sharing and collaboration. Additionally, blockchains can be used to track the provenance of data, ensuring its accuracy and trustworthiness for AI algorithms.

Q3. How does the volatility in the crypto market affect cryptocurrencies like Bitcoin and Ethereum?

The inherent volatility and fluctuation in the crypto market can significantly impact the value of cryptocurrencies like Bitcoin and Ethereum. Market sentiment plays a crucial role in determining the price movements and market cap of these digital assets.

So Is Crypto Really Dead?

In this rollercoaster of a market, there's a common belief that crypto is dead, but let's debunk that myth. The truth is, crypto is far from dead; it's alive and kicking, and it continues to attract more users every day.

As we look to the future, it's essential to stay informed and keep exploring this complex industry. One way to do that is by following the recommendations of experts in the field. Websites like CryptoJobslist offer valuable insights from professionals who closely monitor the crypto industry. Keeping an eye on our analysis and predictions like the impacts of FTX, can help you make informed decisions and stay ahead of the curve. We also have a range of positions within the Web3 industry If you're intrigued by the potential of crypto and Web3, and you possess the skills and knowledge to work in this dynamic environment.

So, don't be swayed by those who claim that crypto is dead. It's a thriving and dynamic market that offers immense potential. Embrace the opportunities, stay informed, and be part of this exciting path into the industry of crypto.